The AI server, as one of the arithmetic infrastructure, can process a large amount of data quickly and accurately due to the advantages of graphic rendering and parallel operation of massive data, so the market value is gradually highlighted. The price of AI server has risen sharply recently because of the shortage and rising price of GPU.

A reporter revealed that the price of the AI server purchased in June last year increased by nearly 20 times in less than a year. During the same period, GPU prices have also been rising, for example, the A100GPU market unit price has reached 150,000, two months ago for 100,000 yuan, an increase of 50%, while the A800 price increase is relatively smaller, the current price of about 95,000 yuan, last month the price of about 89,000 yuan.

"AI server prices have been changing over the past few years, mainly due to its configuration is constantly improving, while its core components GPU global major manufacturers Nvidia, AMD in GPU production capacity is limited, the market GPU supply continues to be tight, it is expected that the future AI server prices will continue to maintain the upward trend." IDC China research manager index to the Securities Times reporter said.

It is worth mentioning that the continued shortage of upstream high-end GPU chips, etc., to a certain extent, also affects the enterprise AI server shipments, which in turn affects the short-term performance of the relevant server listed companies. However, in the long run, AI servers are unanimously favored by the industry, and related listed companies are increasing their layout.

AI big model is hot

"Last June our company purchased eight AI servers, its basic configuration of eight Nvidia A100GPU, storage is 80G, the purchase price was 80,000 yuan / unit, in March this year has risen to 1.3 million / unit, now about 1.6 million yuan / unit, less than a year up nearly 20 times." Recently, Dongguan Songshan Lake, a testing company related to the person in charge told the Securities Times.

"Not only is this AI server price increase, basically all the AI servers related to Nvidia are increasing in price, regret buying less." The aforementioned responsible person said.

No coincidence, a server ODM company related to the person told reporters that from May the company's A100 card also has a 15% increase, the overall AI server for about 10% increase.

In fact, since this year, the market frequently rumored AI server prices rose sharply.

Not long ago, a substantial price increase on the server "small essay" is also widely circulated. It is said that a manufacturer's AI server selling price in March is about 750,000 ~ 850,000 yuan, the average price in April directly revised to 850,000 ~ 1 million yuan.

The reason for this is that a big increase in market demand is the main reason for the price surge of AI servers.

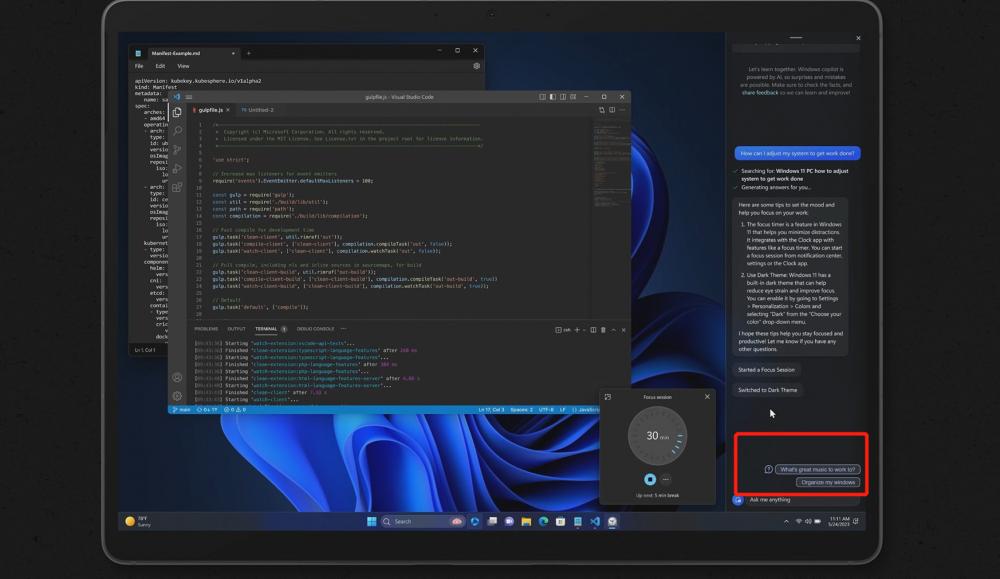

It is understood that after ChatGPT is hot, all major global technology companies are actively embracing AIGC (generative AI) and have made efforts to AI big models. However, the implementation of AI big models requires massive amounts of data and powerful computing power to support the training and reasoning process, and Huawei predicts that in 2030, compared to 2020, the demand for computing power brought about by the AI explosion will increase 500 times.

AI servers as a type of arithmetic infrastructure unit server, due to the widespread use of CPU (central processing unit), GPU and other combinations of heterogeneous architecture, compared to general-purpose servers with the advantages of graphic rendering and parallel computing of massive data, can quickly and accurately process large amounts of data, can meet the powerful arithmetic needs of large models, widely used in deep learning, high-performance computing, search engines, games and other industries, Search engines, games and other industries, and its value is gradually coming to the fore.

"AI applications are increasing, pushing up the demand for arithmetic power, GPU servers will increase, and it is expected that the demand for AI servers containing GPU will continue to increase in the future, bullish on the growth of cloud service providers (CSP) or AI servers." In a recent conference call, Foxconn Group Chairman Liu Yangwei said.

In the past few years, accelerated computing servers (90% of accelerated computing servers are AI servers) have been the main driver of server market growth, with the overall server market increment of $10 billion from 2019 to 2022, of which $5 billion comes from the incremental accelerated computing server market, which is expected to remain vibrant as AI applications enter the era of large models , its growth rate is also expected to be greater than that of the general-purpose server market.

According to IDC data, in 2021, the global AI server market size reached $15.6 billion, up 39.1% year-on-year, exceeding the overall global AI market growth rate of 22.5%, IDC predicts that the global AI server market size will reach $31.79 billion in 2025, with a compound annual growth rate of 19%.

In terms of market pattern, in the global AI server market in the first half of 2021, Wave Information ranked first with 20% market share, followed by Dell, HP, Lenovo and Huawei with 14%, 10%, 6% and 5% respectively, and the current Chinese AI server companies are in the forefront position globally.

GPU continues to be in short supply

Core components GPU continued to be in short supply and prices rose sharply, is also one of the important reasons for the price of AI servers rose sharply.

It is understood that, unlike high-performance servers, general-purpose servers, AI servers, in addition to 2 CPUs, are generally equipped with 4 to 8 GPUs, and some high-equipped servers can even be equipped with 16 GPUs, the current market mainstream AI servers are generally configured with 2 CPUs plus 8 GPUs, so the demand for AI servers will directly multiply the market demand for GPUs, and also The increase in demand for AI servers will directly multiply the market demand for GPU and also increase the cost of GPU, CPU and other components in AI servers.

Data from some organizations show that the cost of AI server (training) chipset (CPU+GPU) accounts for 83% and AI server (inference) chipset accounts for 50%.

It is worth mentioning that the current GPU market is mainly occupied by two Nvidia and AMD, of which Nvidia occupies about 80% of the global market share, and Nvidia GPU production capacity is limited and continues to be in short supply, and prices are rising.

"The vast majority of server manufacturers will use NVIDIA and AMD GPU, but now it is simply difficult to buy the two companies' GPU, even after the U.S. ban on the supply of A100, H100 alternatives A800, H800 have been in short supply." A server industry analyst told reporters.

May 15, the reporter learned from a Nvidia terminal merchants, Nvidia A100 unit price is currently 150,000 yuan, two months ago for 100,000 yuan, an increase of 50%, in addition to A800 is currently about 95,000 yuan, last month the unit price of 89,000 yuan.

"A100 have been banned, there will be no goods, my current goods are a little tail before the ban to buy, sold out, not to mention the price, or is not brand new, there are goods is very good." The businessman told reporters that "A100 will also go up, in August is estimated to rise to 200,000 each."

Another agent revealed that Nvidia A100 prices from December last year, as of the first half of April this year, five months of cumulative price increases reached 37.5%; A800 prices rose by 20% over the same period.

Since an AI server often carries several GPUs, the price increase of AI servers is often higher than the price increase of components.

Some industry media reports, due to the increase in demand for computing power, even after the price increase market demand for Nvidia's top chips did not decrease, which led to Nvidia GPU delivery cycle has also been lengthened, before the pickup cycle of about a month, now basically need three months or longer, and even some new orders "may take until December to deliver ". And in order to cope with the increased order volume, Nvidia also booked an additional 10,000 pieces of advanced packaging capacity from TSMC to meet the production of AI top-spec chips. In addition, there are about 40,000 to 50,000 domestic A100s available for training AI big models, and supply is quite tight. Some cloud service vendors have strictly limited internal use of these advanced chips to reserve them for tasks that require powerful computing.

Server shipments are being held back

The continued shortage of GPUs, among other things, has even affected server industry shipments.

"Now there is a serious shortage of Nvidia GPU, server manufacturers lack of core components, to a certain extent, affect the shipments of related companies." A brokerage analyst told reporters.

The situation can also be seen in the quarterly reports from listed companies. Wave information in the first quarter of this year revenue of 9.4 billion yuan, down 45.59% year-on-year, net profit of 210 million yuan, down 37% year-on-year, Wave information said that the decline in operating income is mainly due to changes in the pace of customer demand over the same period of the previous year, the current period of reduced demand for shipments.

It is understood that Nvidia is the largest supplier of Wave Information, and Wave Information previously purchased almost all GPU chips from Nvidia, which accounted for 23.83% of Wave Information's purchases in 2021.

In March this year, the U.S. included 28 Chinese companies, including Wave Information, in its latest list of U.S. entities. According to the U.S. Department of Commerce, companies included in the list of entities must obtain authorization from the U.S. government to obtain U.S. products and technologies.

Peer-to-peer, Industrial F&T's revenue in the first quarter reached 105.888 billion yuan, up 0.79% year-on-year, with net profit of 3.128 billion yuan, down 3.91% year-on-year, but gross margin improved 0.6 percentage points to 7.4% year-on-year.

Industrial Fulian insiders told the Securities Times that Industrial Fulian AI servers have been applied to ChatGPT during the period, and the continued hotness of AI big model technology provides room for Industrial Fulian to improve its gross margin, and the company is also accelerating the share and R&D speed of AI servers and high-efficiency computing (HPC) products.

It is understood that IFT's cloud computing server shipments continue to maintain the world's number one position. In 2017, IFT jointly launched the world's first AI server HGX1 with Nvidia and Microsoft, and the server used by ChatGPT is HGX1, which has now been iterated to the fourth generation.

Comments0