OpenAI has made another big move and will open up networking capabilities and numerous plugins to all ChatGPT Plus users, allowing ChatGPT to access the Internet and use over 70 third-party plugins.

One of these plugins, called Portfolio Pilot, is exciting for all investors. Users can copy and paste their portfolios into the tool for analysis, get investment advice, search for market information, and ask it questions.

Best of all, all of this is free.

The first officially certified "Investment Plugin"

Portfolio Pilot, co-founded by AI software entrepreneur Alex Harmsen and released back in early May, claims to be the first officially certified "investment Plugin.

Harmsen said the software is backed by hedge fund models.

In a statement, he said: We are on an ambitious mission to create a complete picture of how the economy works. This will dramatically improve the investments of millions of people, reduce decision risk and eliminate huge inefficiencies in the financial sector.

In fact, there have been attempts to use this chatbot to pick stocks since the ChatGPT interview last November.

A recent study released by Motley Fool found that 47% of U.S. adults already use ChatGPT for stock picking, and 69% said they would like to do so.

According to the survey, Americans with higher incomes are most likely to use ChatGPT for investment advice, with 77% of them saying they have used it for stock picking.

So, let's take a look at how ChatGPT performs with the new investment plugin.

First, users ask what the best low expense ratio gold ETF is, and ChatGPT not only gives the name of the ETF, but also key data such as annual return expected return.

It also compares the return expectations of two stocks.

When users upload their portfolio data, ChatGPT not only gives a score for the portfolio in just a few seconds, but also gives suggestions for improvement.

It is also not a problem to check the stock prices of public companies, P/E ratios and schedules of earnings calls and company news.

When users asked for recent Tesla news, ChatGPT not only stated the news, but also provided the source and URL link.

As you can see, ChatGPT can indeed answer simple investment questions, and it has also changed the problem of "nonsense".

According to Hyungjin Ko and Jaewook Lee of Seoul National University, it may be a convenient option for investors who lack knowledge or expertise in asset management, and even professional portfolio managers can use ChatGPT to improve their efficiency.

ChatGPT is not the "prophet" of the financial industry

But it doesn't help investors predict market trends.

Earlier this year, two researchers tested ChatGPT's financial capabilities by asking it to create a portfolio from 40 assets - including U.S. large-cap stocks, cryptocurrencies, commodities, currencies and bonds.

The test was run 10,000 times, during which the AI's work was compared to a randomly selected portfolio. The researchers found that ChatGPT outperformed the random portfolios and created sufficiently diversified portfolios.

"ChatGPT can identify abstract relationships between assets, especially in terms of how they differ from asset classes," the researchers wrote.

However, the researcher notes that ChatGPT should not be treated as a market prediction machine, and other users have noted that it has provided misinformation.

"ChatGPT is not a 'prophet' for the financial industry, but rather an 'assistant' or 'co-pilot' for investors and portfolio managers. " the researchers wrote, "ChatGPT has the potential to revolutionize asset allocation practices when used appropriately within an established framework."

At the time, ChatGPT's data was still based on information available through September 2021, so it did not take into account factors such as the Russian-Ukrainian conflict, inflation, and the Fed's aggressive tightening process in 2022.

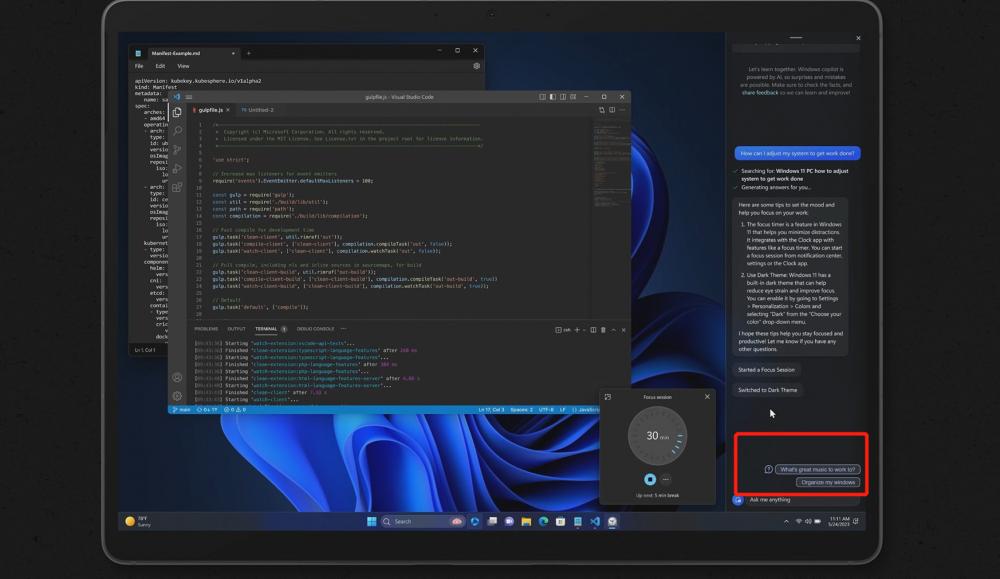

But by next week, OpenAI will roll out networking and plug-in capabilities to all ChatGPT Plus users, which means the last seal is completely lifted and it will serve users with the latest information and messages.

The study concludes:

It is important to note that the role of human experts in portfolio management remains crucial, as they must work in concert with theoretical frameworks and investment theories to ensure proficiency and reliability in validating accurate information from LLMs (Large Language Models).

Comments0